income tax submission malaysia

There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make. Calculations RM Rate TaxRM 0-2500.

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star

30 6th year and.

. Edith Tucker voted multiple times for an income tax. During the Income Tax Course should HR Block learn of any students employment or intended employment with a competing professional tax preparation company HR Block reserves the right to immediately cancel the students enrollment. News from San Diegos North County covering Oceanside Escondido Encinitas Vista San Marcos Solana Beach Del Mar and Fallbrook.

Introduction Individual Income Tax. The SME company means company incorporated in Malaysia with a paid up capital of. The National Executive Council shall on the earlier of the date it receives the submission of the Commissioner General or the date.

This means that low-income earners are imposed with a lower tax rate compared to those with a higher income. 30062022 15072022 for e-filing 6. Employees work in return for wages which can be paid on the basis of an.

CTEC 1040-QE-2662 2022 HRB Tax Group Inc. On the First 2500. Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to.

2021 ITRF Submission Dateline. I have been a neighbor and supporter of Tuckers for several years I know that is a lie and bold scare tactic. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021.

10 Perkara Wajib Tahu Tentang Cukai Pendapatan LHDN. Malaysia My Second Home. Tax Saving - Know about how to income tax saving for FY 2022-23Best tax saving tips options available to individuals and HUFs in India are under Section 80C.

For manual submission of monthly tax deductions of unregistered users and for one time submissions only. Home Income Tax. Income Tax payment.

This section only applies if you want to calculate your income tax manually. What is the Proper Way to Submit the Tax Payable Estimation. Cut to income tax in doubt under new Chancellor.

Jeremy Hunt says some taxes will have to go up By Melissa Lawford. Applicants aged below 50 years are required to show proof of liquid assets worth a minimum of rm500000 and offshore income of rm10000 per monthfor. A fundraising email from NH.

Income Tax - Know about Govt of Indias Income tax guide rules tax efiling online slabs refund deductions exemptions calculations types of taxes FY 2022-23. Introduction to Monthly Tax Deduction MTDPCB - Part 1 of 3 10th Aug 2022. Foreigners should note that when renewing a work permit you will need to show a copy of your tax submission for the previous year.

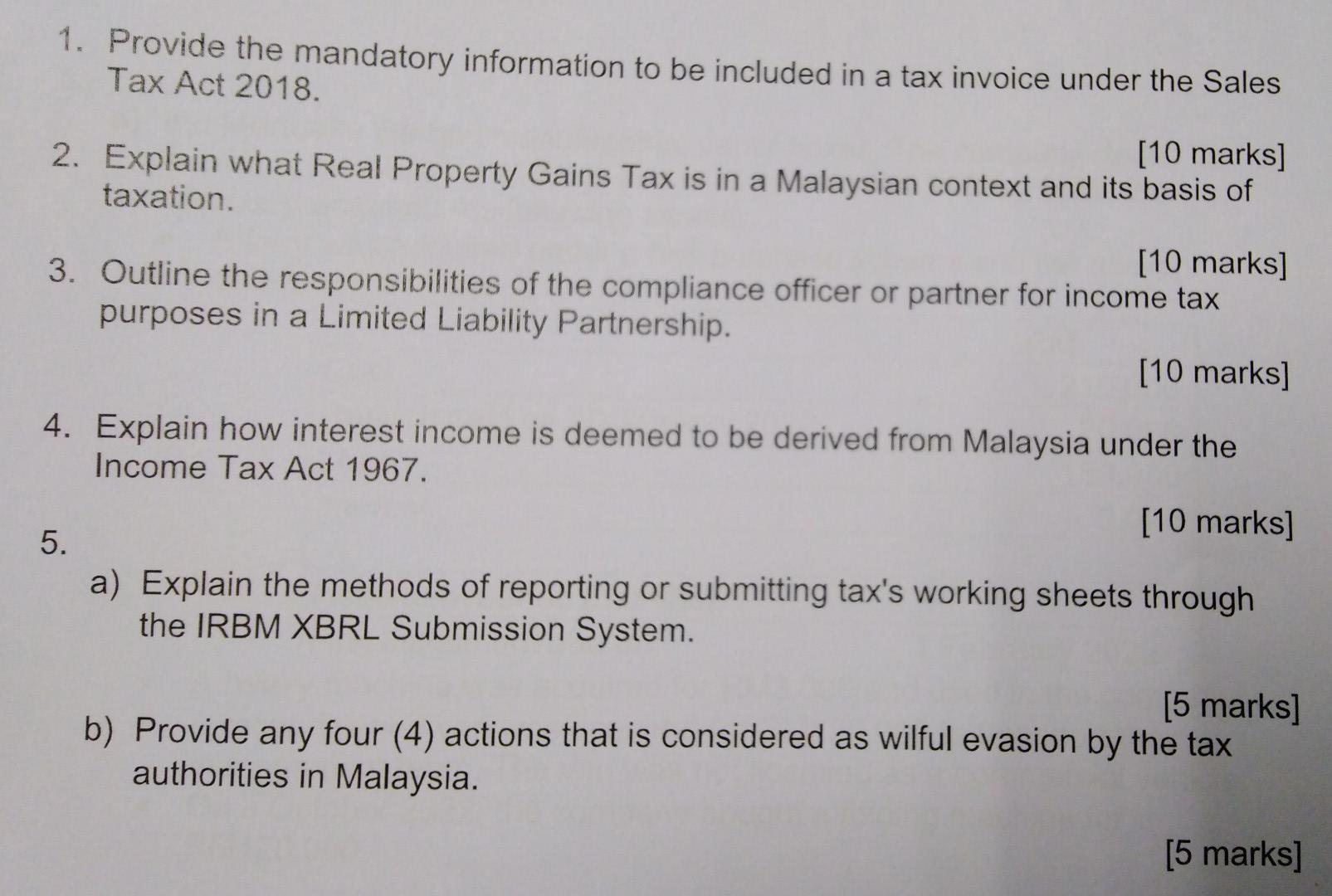

This is effected under Palestinian ownership and in accordance with the best European and international standards. Bayaran Cukai Keuntungan Harta Tanah Available in Malay Language Only. We recommend submitting PCB via e-Data PCB as it is the most convenient option of the three.

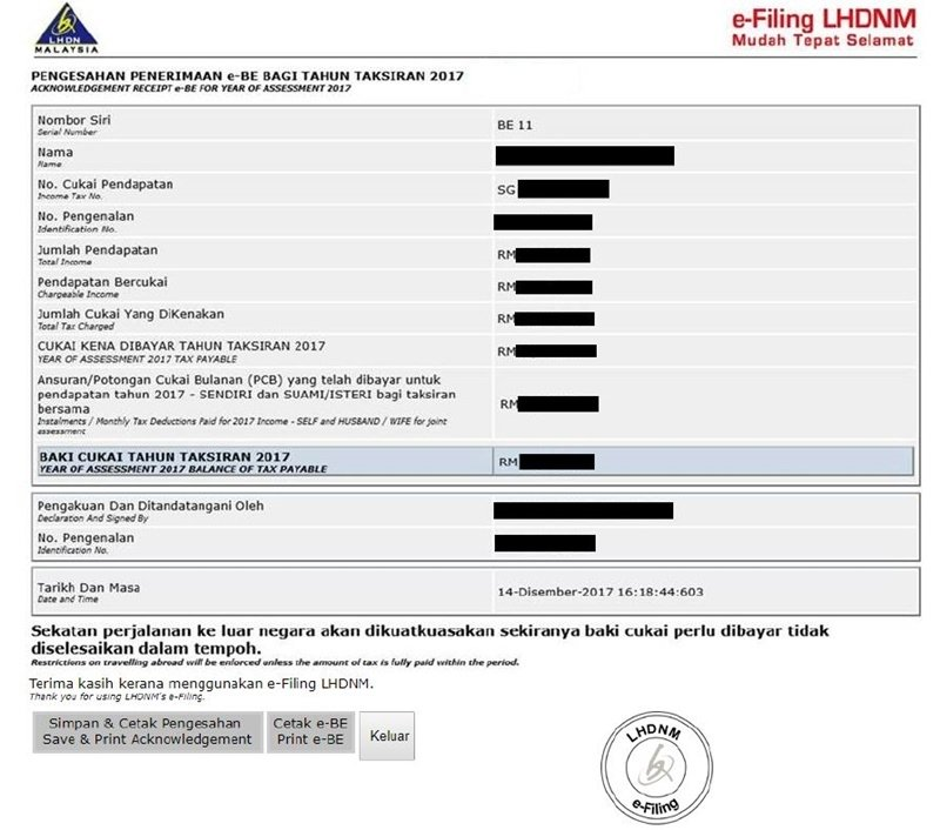

Arts and Culture Malaysia and entrance fees to tourists attractions incurred on or after 1st March 2020. The income tax return verification will be displayed on the screen on the successful submission. To prevent tax evasion and corruption GST has brought in strict provisions for offenders regarding penalties prosecution and arrest.

Guyana Republic of India Jamaica Republic of Kenya Kingdom of Lesotho Republic of Malawi Malaysia Malta Mauritius Republic of Nauru New Zealand Federal. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020. Return Form RF Filing Programme.

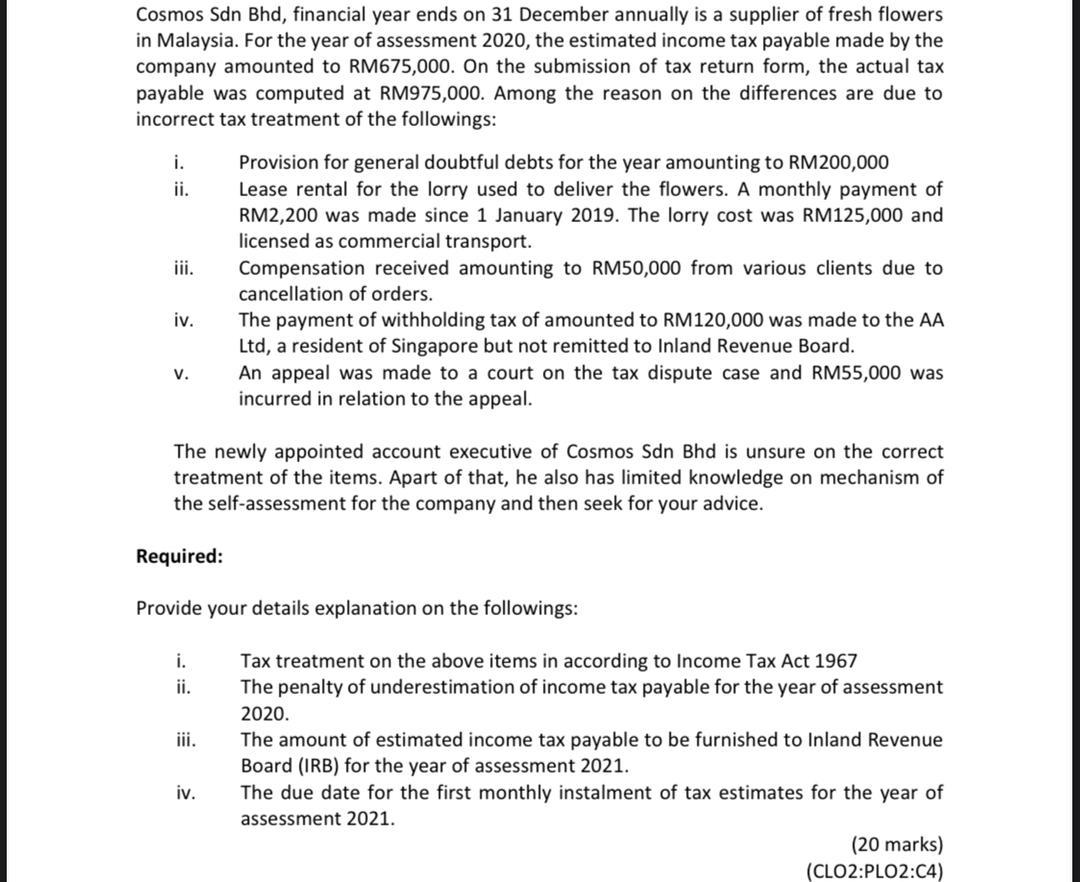

Offences Penalties Offences. The tax estimation submission in Malaysia under Section 107C of the Malaysian Income Tax Act 1967. We have mentioned a few here.

Income tax return for individual who only received employment income Deadline. Income Tax Act 1959 No. Usually based on a contract one party the employer which might be a corporation a not-for-profit organization a co-operative or any other entity pays the other the employee in return for carrying out assigned work.

Additional lifestyle tax relief related to sports activity expended by that individual for the following. Once you do you will be asked to sign the submission by providing your identification number and MyTax password. There are 21 offenses under GST.

Jeb Bradley R-Wolfeboro claims that Rep. EUPOL COPPS the EU Coordinating Office for Palestinian Police Support mainly through these two sections assists the Palestinian Authority in building its institutions for a future Palestinian state focused on security and justice sector reforms. Form P Income tax return for partnership Deadline.

Most of the hassle bustle is based on the submission of various insurances and rent receipt. Procedures For Submission Of Real Porperty Gains Tax Form. However you dont have to memorise all this Simply use the income tax calculator in Malaysia that I recommended KiraCukaimy and itll automatically give your income tax guestimate.

Form B Income tax return for individual with business income income other than employment income Deadline. Senate GOP PAC signed by Sen. 1st year - 5 th year.

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia. Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system. The student will be required to return all course materials.

For the entire list of 21 offenses please go to our main article on offenses. Thai Income Tax Bands 2022. As per Income Tax Act ITA 1967 any person who committed for an offence will be fine either through penalty of imprisonment or both depending on severity or the number of offences.

But if you want to save on taxes and safe. Employment is a relationship between two parties regulating the provision of paid labour services. Tax Offences And.

The system is thus based on the taxpayers ability to pay. Profits made on the sale of property is subjected to current real property gains tax rate set by the government of malaysia. Download the ITR-V form from the link displayed sign it and submit it to the.

Malaysia Personal Income Tax Rate. Thailand taxes both residents and non-residents on income derived from employment or business carried out in Thailand regardless of whether payment is remitted in or outside of. By using the prescribed form CP204.

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8. How second home owners could save 240k in tax. How To Pay Your Income Tax In Malaysia.

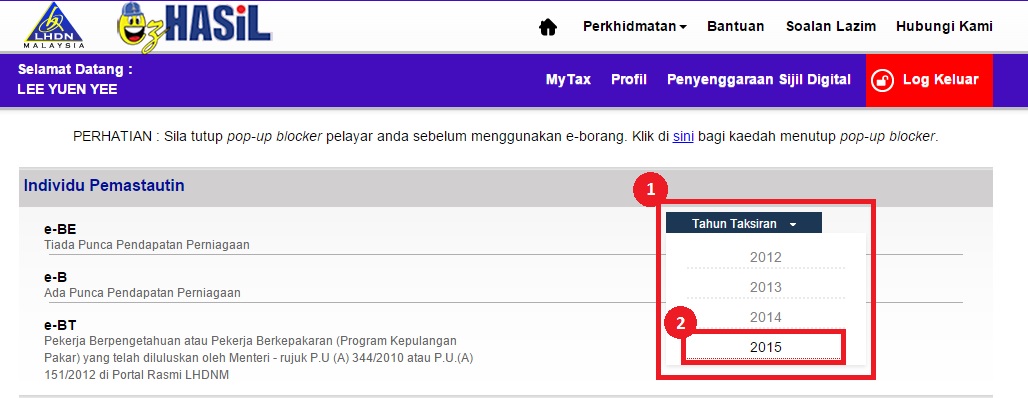

It may seem intimidating to use e-Filing form at first but it really is easy to do. 30042022 15052022 for e-filing 5. The recommended form of the first submission is Form CP204 and revising the Form CP204A initial submission.

The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. CP204 Due Date of the Submission. Schedule On Submission Of Return Forms RF Contoh Format Baucar Dividen.

The major offenses under GST are. Details of Income Tax Offences Fines and Penalties in Malaysia. For small and medium enterprise SME the first RM600000 Chargeable Income will be tax at 17 and the Chargeable Income above RM600000 will be tax at 24.

Malaysia Personal Income Tax E Filling Guide 2021 Lhdn

How To File Income Tax In Malaysia Using E Filing Mr Stingy

A Malaysian S Last Minute Guide To Filing Your Taxes

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

7 Tips To File Malaysian Income Tax For Beginners

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Personal Income Tax E Filing For First Timers In Malaysia

Individual Income Tax In Malaysia For Expatriates

How To Fix A Mistake In Your E Filing For Malaysians By Juinn Tan Medium

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

Just An Ordinary Girl How To Do E Filing For Income Tax Return In Malaysia

Solved Cosmos Sdn Bhd Financial Year Ends On 31 December Chegg Com

Solved 1 Provide The Mandatory Information To Be Included Chegg Com

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

China Clarifies Deadlines For Filing Tax Returns In 2021 China Briefing News

Comments

Post a Comment